by Bryson Bichwa, China Africa News-Pretoria

Pretoria-South Africa- China’s economy is no longer simply about manufacturing for the world it’s about millions of Chinese households who are buying more, eating better, and looking outward for new tastes and premium goods. At the same time, South Africa and the rest of Africa are looking for markets beyond the old routes, aligning their agricultural, mineral and manufacturing sectors with those shifts. Against this backdrop, the new deal opening China’s doors to South African stone-fruit becomes more than an export contract it becomes a strategic move in Africa’s changing place in global trade.

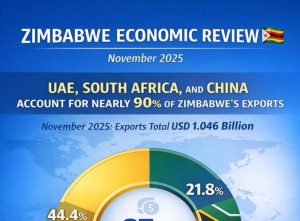

Over recent decades the trade relationship between China and South Africa has deepened significantly. China has been South Africa’s largest trading partner for many years, and South Africa is China’s largest partner in Africa. One report noted that trade between the two grew over 35 times in 25 years, reaching around US$57 billion. Within that large sea of commerce lie new niches: fresh fruit, high-quality produce, and off-season windows where southern-hemisphere growers can meet northern-hemisphere demand.

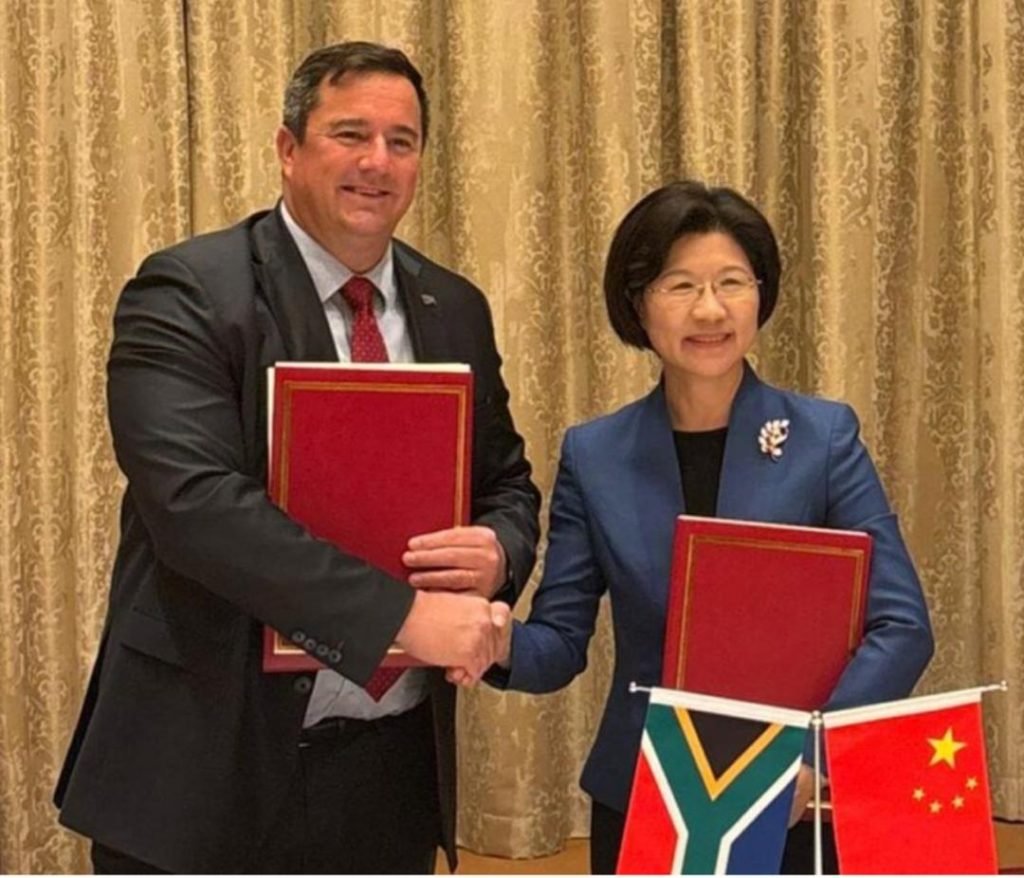

In October 2025 South Africa and China signed a landmark protocol that opens the Chinese market to five types of South African stone fruit apricots, peaches, nectarines, plums and prunes. This is not simply another agricultural deal: it is the first time China has granted access for multiple fruit types from a single country under one protocol. The significance lies not only in access but also in timing and strategy South African producers can export into China’s winter and spring seasons precisely when local Chinese fruit is less abundant, thereby securing a meaningful seasonal window.

Behind the pages of the agreement is a wider shift: China’s rising middle class, which is increasingly willing to spend on better food and imported products, is creating opportunities across sectors. South Africa’s agricultural industry sees this trend and is positioning itself accordingly. The Minister of Agriculture described the deal as “a major breakthrough… at a time when diversification is essential for our agricultural resilience.” It is about more than fruit; it is about aligning with new consumption patterns, expanding markets, and reducing reliance on traditional export destinations.

The numbers suggest promise: South Africa’s fruit exports to China reached roughly US$410 million in 2024. Analysts estimate that this new market access could unlock about R400 million over the next five years for the stone-fruit sector alone, with room to double in a decade. Beyond the direct value is the job creation, the investment in infrastructure and upgrading of orchards and packing facilities all reinforcing the productive base of the industry.

For Africa at large, the deal signals something important. It reflects how African producers and economies are rethinking their trade relationships: moving from a model dominated by exports to Europe or reliance on commodity cycles, into a more diversified set of partnerships especially in the Global South. China’s role in Africa is evolving from raw-material buyer to a full-fledged partner in manufacturing, agriculture, infrastructure and logistics. Still, the deal won’t succeed simply because it was signed. South African producers must maintain quality, consistency, and deliver on schedule China’s demand is real, but the competition is fierce. The logistics chain must function: from the farm, to packing, to refrigerated containers, to arrival in China’s markets. The timing matters, particularly since the export season coincides with China’s off-peak domestic production.

In many ways this is a microcosm of how trade in Africa is changing. No longer are African exports just looking outward; they are looking strategically, recognising global shifts and seizing windows that match the rhythms of other hemispheres. It is about timing, quality, and partnership.

If this first major fruit deal bears fruit, it could chart a path for other sectors. South Africa’s agricultural sector, as well as manufacturers and exporters across Africa, could look to China’s market not just as a destination but as part of a broader value chain. The challenge will be maintaining standards, logistics, and competitive pricing but the opportunity is real.

In short: Africa’s fruit growers are beginning to harvest more than just fruit; they are harvesting possibility. China’s middle-class table is opening wider and for those who are ready, the plates are set.