By Senior Editor,China Africa News

Kampala-It began in mid-2025 when China announced it would remove all import tariffs on products from African countries with diplomatic ties a sweeping policy shift affecting 53 nations.

The impact was immediate for Ugandan coffee exporters. Exports of Ugandan coffee bound for China soared reports show that in March 2025 alone, shipments rose by 190%.

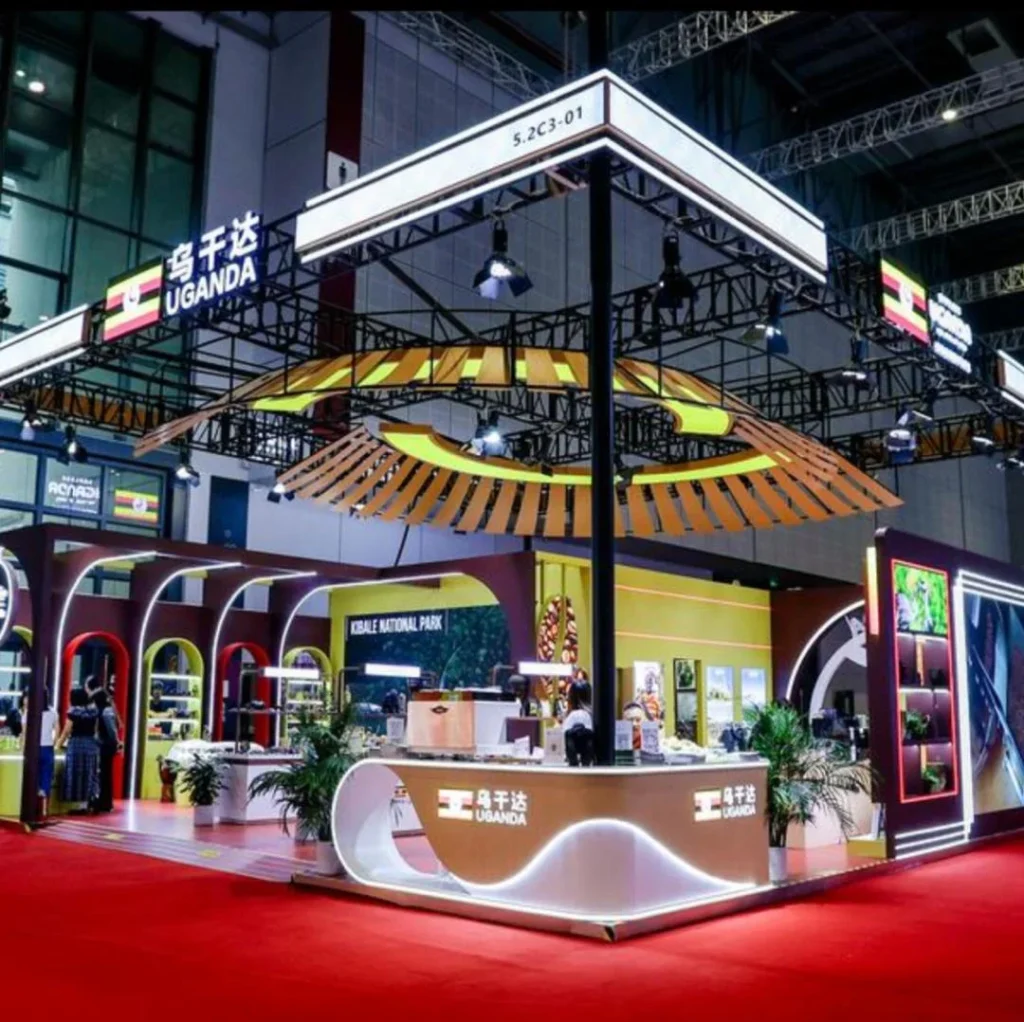

At the 2025 China International Import Expo (CIIE) in Shanghai, Ugandan exporters backed by the government secured deals worth first-time contracts totalling US$3 million. Under a new agreement with a major Chinese coffee house chain, Uganda’s beans now have a path directly from farms to cafés across China.

For many Ugandan farmers and exporters including the owners of the processing facility in Ntungamo this isn’t just about higher export volumes. It’s a transformation in opportunity. The CEO of one leading Ugandan coffee firm said the zero-tariff policy offers a far more conducive business environment compared with markets still burdened by high trade duties.

Behind these numbers lies a deeper shift. Coffee is not merely a cash-crop in Uganda: some 1.8 million households depend on it for livelihoods. With easier access to China’s massive consumer market, and rising demand there for quality beans, Uganda may be entering a new era one where coffee can fuel rural incomes, local processing, and value-addition.

This moment, however, is part of a longer arc. The zero-tariff initiative builds on past reforms. For years, China gradually expanded duty-free access for least-developed African countries (LDCs). As of December 1, 2024, China extended zero-tariff treatment to all products from diplomatic-ally LDCs and later announced readiness to extend such treatment to all 53 African countries with ties.

Now, amidst weakening supply from traditional coffee producers globally and growing coffee culture in China, African beans are increasingly competitive. Ugandan Arabica and Robusta with their distinct quality find themselves in rising demand.

What this means: Uganda has a real shot at turning coffee into more than a raw-commodity export. If farmers, processors and exporters invest in quality, standards, processing capacity and supply-chain reliability, the country could build an export-driven growth engine.

In doing so, coffee could provide meaningful jobs and stable income for rural households that long depended on middlemen and unstable commodity markets.

But the road ahead demands caution and preparation: meeting export standards, ensuring sustainable supply, upgrading processing infrastructure, and protecting farmers’ interests. If Uganda plays its cards right, the beans that once appealed only to distant buyers may soon be fuelling local development and also warming mugs across China.